Dell EMC tops the data centre hardware & software market

New research has found that – perhaps unsurprisingly – spending on data center hardware and software is on the rise.

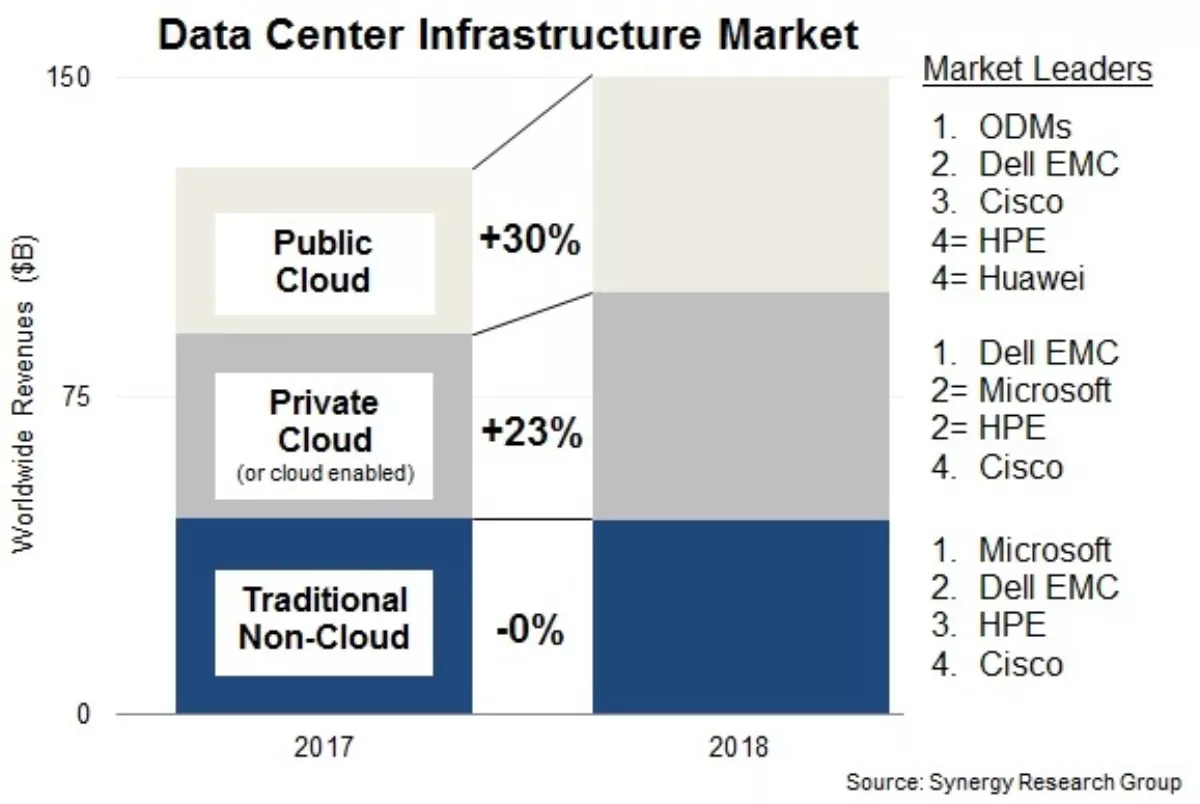

According to Synergy Research Group, spending on the global sector grew by 17% in 2018, largely driven by burgeoning demand for public cloud services and a requirement for ever-richer server configurations, which drove up enterprise server average selling prices.

Total data center infrastructure equipment revenues, including both cloud and non-cloud, hardware and software, reached approximately US$150 billion in 2018, with public cloud infrastructure accounting for well over a third of the total.

Private cloud or cloud-enabled infrastructure accounted for a little over a third of the total. Servers, OS, storage, networking and virtualisation software combined accounted for 96% of the data center infrastructure market, with the balance comprising network security and management software.

"Cloud service revenues continue to grow by almost 50% per year, enterprise SaaS revenues are growing by 30%, search/social networking revenues are growing by almost 25%, and eCommerce revenues are growing by over 30%, all of which are helping to drive big increases in spending on public cloud infrastructure," says Synergy Research Group chief analyst John Dinsdale.

In terms of market share, ODMs in aggregate account for the largest portion of the public cloud market, with Dell EMC being the leading individual vendor, followed by Cisco, HPE and Huawei.

Dell EMC also was top of the pile in 2018's private cloud market, followed by Microsoft, HPE and Cisco. The same four vendors led in the non-cloud data center market, albeit with a different ranking.

By segment, Dell EMC is the leader in both server and storage revenues, while Cisco is dominant in the networking segment. Microsoft features heavily in the rankings due to its position in server OS and virtualisation applications.

Outside of these three, the other leading vendors in the market are HPE, VMware, IBM, Huawei, Lenovo, Inspur and NetApp. Inspur and Huawei were the two leading vendors that achieved the strongest growth in 2018.

"We are also now seeing some reasonably strong growth in enterprise data center infrastructure spending, with the main catalysts being more complex workloads, hybrid cloud requirements, increased server functionality and higher component costs. We are not seeing much unit volume growth in enterprise, but vendors are benefitting from substantially higher ASPs," concludes Dinsdale.