Big cloud providers continue to squeeze out smaller players

Last year saw almost manic growth in revenue for cloud providers as businesses continue to seek the benefits the services can provide.

New data from Synergy Research Group reveals spending on cloud infrastructure in the fourth quarter of 2018 to have surged 45 percent year-on-year, sealing a full-year growth rate of 48 percent.

Furthermore, the growth is actually accelerating as the rates achieved in 2018 were higher than those experienced in 2017.

"Q4 tops off a banner year for the cloud market with the annual growth rate actually nudging up from the previous year, which is an unusual phenomenon for a high-growth market of this scale," says Synergy Research Group chief analyst John Dinsdale.

While the growth does paint a pretty picture, looking deeper within it is a slightly different story.

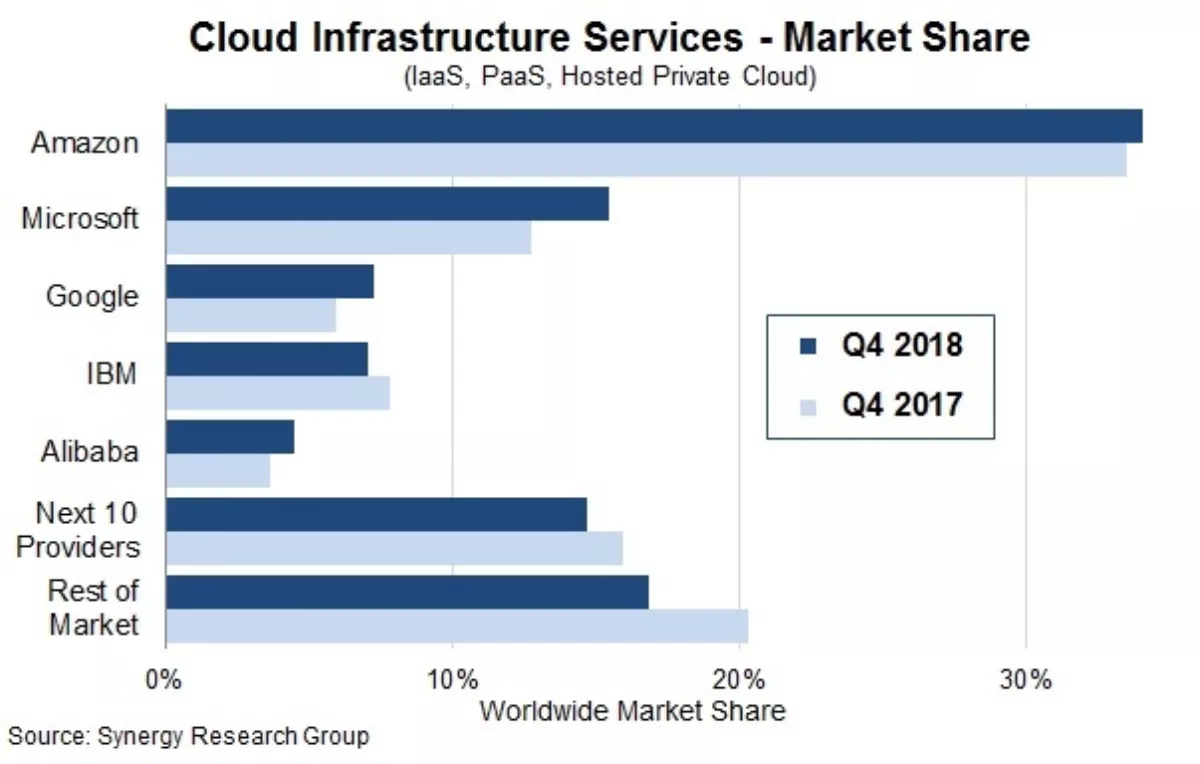

Amazon is by far and away the dominant market leader with the giant again increased its market share. Astonishingly, its share of the market is equivalent to the combined efforts of its next four competitors.

However, it certainly wasn't a bad year for the other big three. Microsoft, Google, and Alibaba again overshadowed the overall market growth rate with all three gaining significant market shares - particularly Microsoft.

Of course this growth has to come at the expense of others and this was most pronounced among small-to-medium sized cloud operators, who collectively lost five percentage points of market share over the last four quarters.

According to Canalys, while many of these smaller players are still growing revenues, they're finding themselves unable to keep up with the market leaders. Among the leaders, IBM's prime focus is slightly unique from the others as it remains the strong leader in the hosted private cloud services segment of the market.

As most of the major cloud providers have now unveiled their earning data for Q4, Synergy has estimated the quarterly cloud infrastructure service revenues - which includes IaaS, PaaS, and hosted private cloud services) to be approaching US$20 billion, equating to a full-year total of nearly $70 billion.

The bulk of the market was taken up by public IaaS and PaaS services with these growing by 49 percent in Q4. The dominance of the top five providers is most keenly pronounced in public cloud as they control more than three quarters of the market. Regionally, the cloud market continues to experience strong growth around the globe.

"The rate at which the market leaders continue to expand is really rather impressive. In aggregate the top five drove up their revenues in these segments by 60 percent in 2018, which has caused us to review and increase our five-year forecast for the market. Inevitably there will be a few road bumps along the way but these will be minor relative to the factors that continue to drive the market," concludes Dinsdale.