Positive results for semiconductor market, but decline looms

New statistics from Gartner show the global semiconductor market to be in good stead.

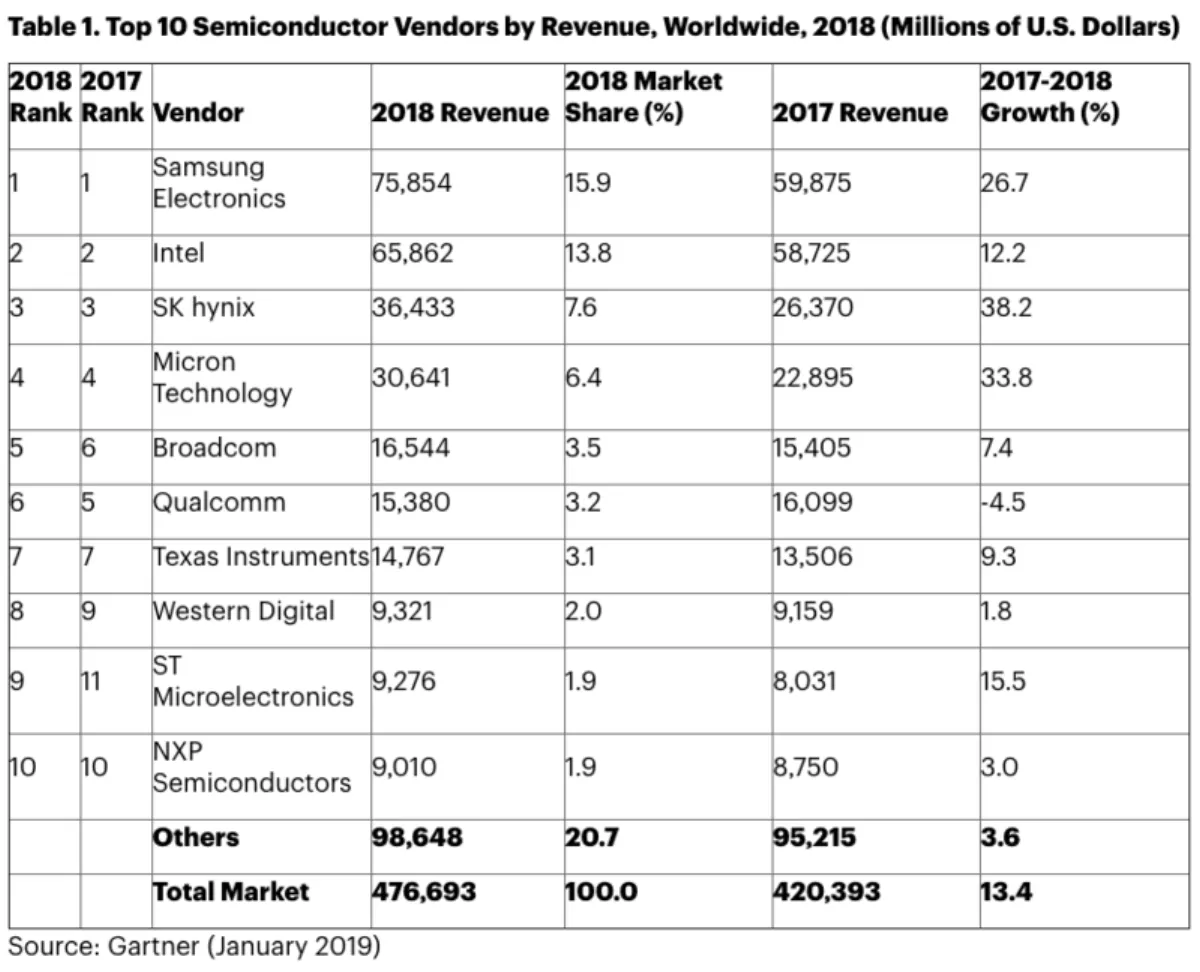

According to the research giant, the market brought in US$476.7 billion of revenue in 2018, representing a 13.4 percent increase from the previous year.

The memory category tightened its hold on the market as the biggest contributor, accounting for 34.8 percent of the total revenue, up from 31 percent in 2017.

"The largest semiconductor supplier, Samsung Electronics, increased its lead as the No. 1 vendor due to the booming DRAM market," says Gartner vice president and analyst Andrew Norwood.

"While 2018 continued to build on the growth established in 2017, the overall gains driven by memory were at half the 2017 growth rate. This is attributed to memory entering a downturn late in 2018.

It's clear the big players have plenty of sway in the market, as the top 25 semiconductor vendors account for almost 80 percent of the market and saw their combined revenue increase 16.3 percent from 2017, while the rest of the market grew just 3.6 percent.

Intel's semiconductor jumped 12.2 percent from 2017, and Gartner says this has been fuelled by an increase in unit and average selling price (ASP). The top four vendors of 2017 retained their positions in 2018.

"The current rankings may see significant change this year with the expectation that memory market conditions will weaken in 2019," says Norwood.

"Technology product managers must prepare for this limited growth to succeed in the semiconductor industry.

Using memory vendors as an example, Gartner affirms they should prepare for imminent oversupply and intense margin pressure as new entrants from China emerge by investing in research and development on continued node transitions, emerging memory technologies and new manufacturing technologies.

Non-memory vendors on the other hand, should be focusing on designing in-activity with key customers that have been enduring high memory pricing. An increasingly saturated smartphone market means application processor vendors should look for other opportunities in wearables, Internet of Things (IoT) endpoints and automobiles.

When it comes to semiconductor devices, memory was both the biggest and highest performing device category for the year with a 35 percent stake of the market and 27.2 revenue growth.

Within this segment, despite still posting a 6.5 percent revenue increase, NAND flash underwent a significant slowdown as oversupply saw ASP declines. The main drivers of its positive growth were solid-state drives (SSDs) and the increasing demand for more content in smartphones.

Application-specific-standard products (ASSPs) came in second place, with limited growth of 5.1 percent put down to an uncertain smartphone market in parallel with a declining tablet market.

There was significant merger and acquisition activity in the market, including the much publicised hostile takeover of Qualcomm by Broadcom which ultimately failed as the US government stepped in. Deals that did meet the mark included Toshiba spinning off its NAND business into Toshiba Memory and Microchip's acquisition of Microsemi.

"2019 will be a very different market from the previous two years," says Norwood.

"Memory has already entered a downturn, there is the looming trade war between the US and China, and mounting uncertainty about the global economy.