Four Chinese OEMs among top 10 global semiconductor customers

High regional growth has seen a slight reshuffle in the world's top semiconductor chip buyers.

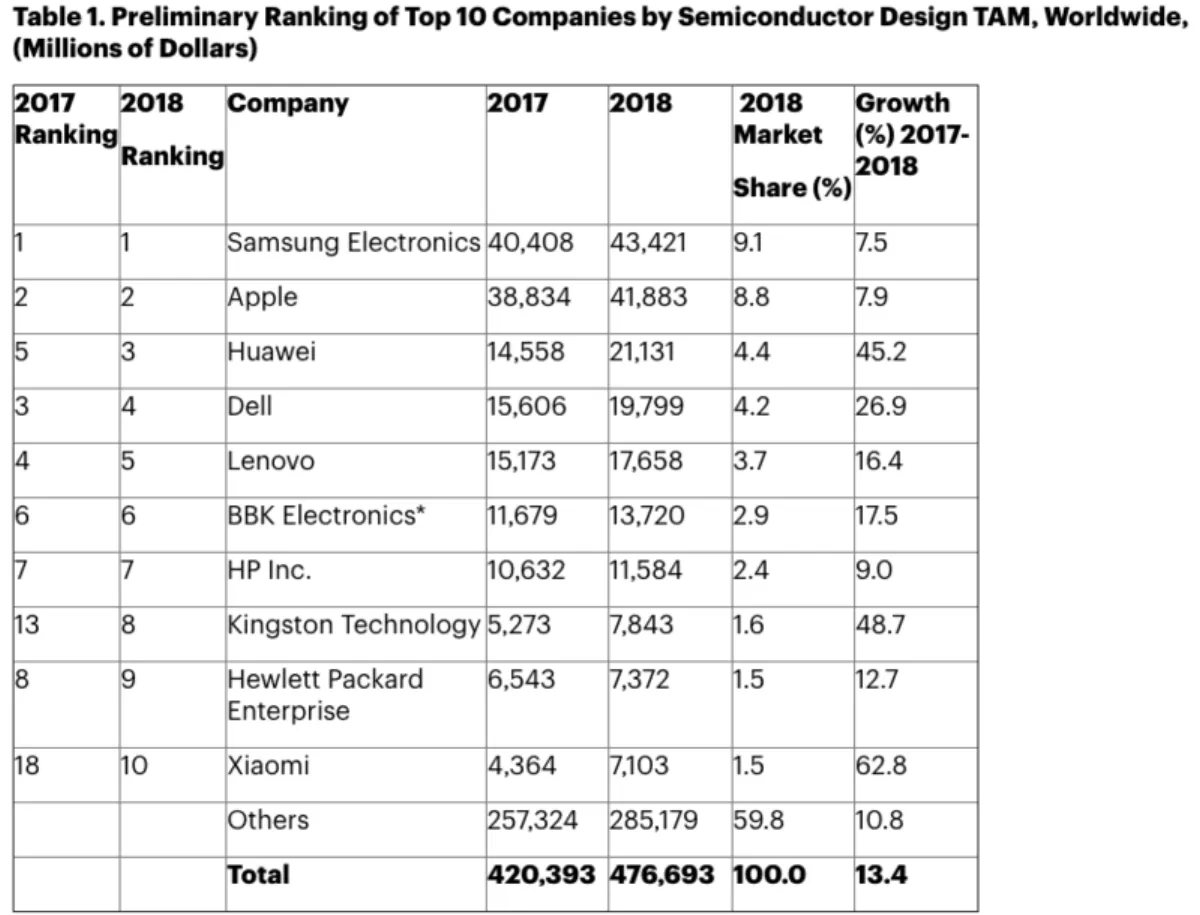

According to new data from Gartner, Samsung Electronics and Apple remained the top two customers in 2018 with a combined stake in the global market of 17.9 percent.

However, this is actually a 1.6 percent decrease from the previous year. Despite this, the top 10 original equipment manufacturers (OEMs) increased their share of chip spending to 40.2 percent in 2018, up from 39.4 percent in 2017.

Gartner principal analyst Masatsune Yamaji says the big movers and shakers have come from China.

"Four Chinese original equipment manufacturers (OEMs) — Huawei, Lenovo, BBK Electronics and Xiaomi — ranked in the top 10 in 2018, up from three in 2017. On the other hand, Samsung Electronics and Apple both significantly slowed the growth of their chip spending in 2018," said Yamaji.

"Huawei increased its chip spending by 45 percent, jumping in front of Dell and Lenovo to the third spot.

Eight of the top 10 companies from 2017 remained in the top 10 in 2018, with LG Electronics and Sony being ousted by Kingston Technology and Xiaomi - the latter company rose eight places to reach 10th place after increasing its semiconductor spending $2.7 billion in 2018, a 63 percent year-on-year growth.

TAM = total available market *BBK Electronics includes Vivo and OPPO Note: Numbers may not add to totals shown because of rounding Source: Gartner (February 2019)

Gartner says significant changes in semiconductor buyers' rankings have been driven by continued market consolidation in the PC and smartphone markets. This is especially apparent with the big Chinese smartphone OEMs as they have looked to increase their market presence by taking out or purchasing competitors.

This trend is expected to continue, which as a result will make it more difficult for semiconductor vendors to maintain high margins.

Memory prices also impacted the market, as while DRAM average selling price (ASP) has been high in the past two years, it is now on the decline. However, Gartner says the impact is limited as OEMs will increase their memory content when the ASP drops and also invest in premium models.

Speaking of memory chips, Gartner expects the sector's share of revenue in the total semiconductor market will be 33 percent in 2019 and is set to slightly increase to 34 percent in 2020.

"With the top 10 semiconductor chip buyers commanding an increasing share of the market, technology product marketers at chip vendors must allocate a majority of their resources to their top 10 potential customers," says Yamaji.

"It is crucial that they take advantage of the open budget that is available due to the weakening memory ASPs and encourage customers to use advanced chips or increase memory content.