EMEA external storage market hits record high, Dell EMC on top

The final quarter of 2018 saw record growth for the external storage market in Europe, the Middle East, and Africa (EMEA)

That's according to IDC's EMEA Quarterly Disk Storage Systems Tracker, which found that the market grew 9.4% year-on-year growth in dollars (12.9% in Euros).

The segment closed the year with record growth (+16.4% in dollars, +11.8% in Euros) on the back of strong investments.

Significant growth was seen in the all-flash-array (AFA) market as it edged towards a 40% stake of total shipments in value (37% in the fourth quarter alone and 35% for the full year), well on the way to overtake hybrid arrays (HFAs) as the most popular array type.

While still holding the majority of the total market 45.1% of total shipments in value terms for the full year (43.8% for the quarter), the HFA segment saw slower year-on-year growth (+5.8% in 2018Q4 versus 32% growth in AFAs) and IDC says it is only a matter of time before it is surpassed by the AFA segment.

The growth in flash-powered arrays is happening at the expense of HDD-only arrays, which remain mostly confined to secondary workloads. HDD-only arrays lost 12.8% year-on-year for the quarter and 18.4% for the full year.

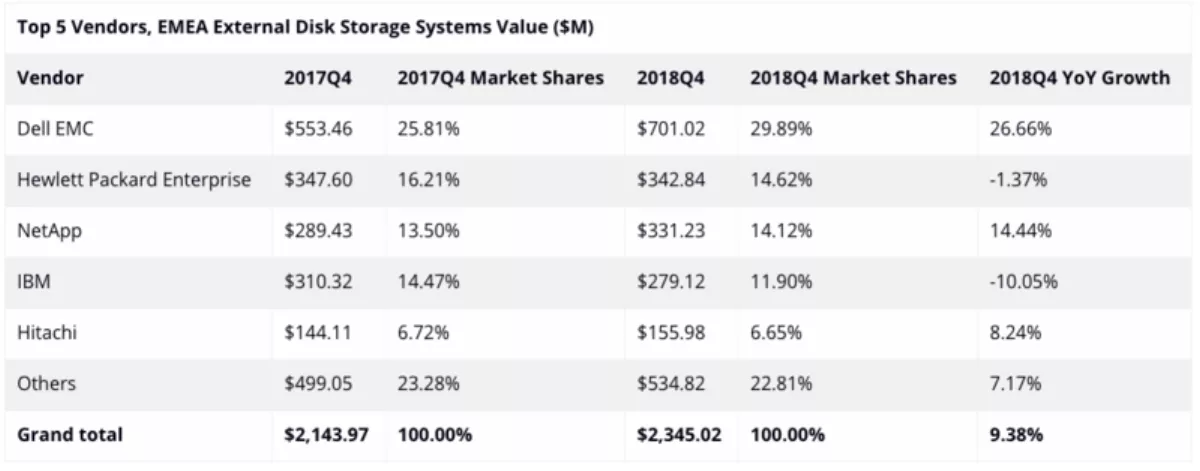

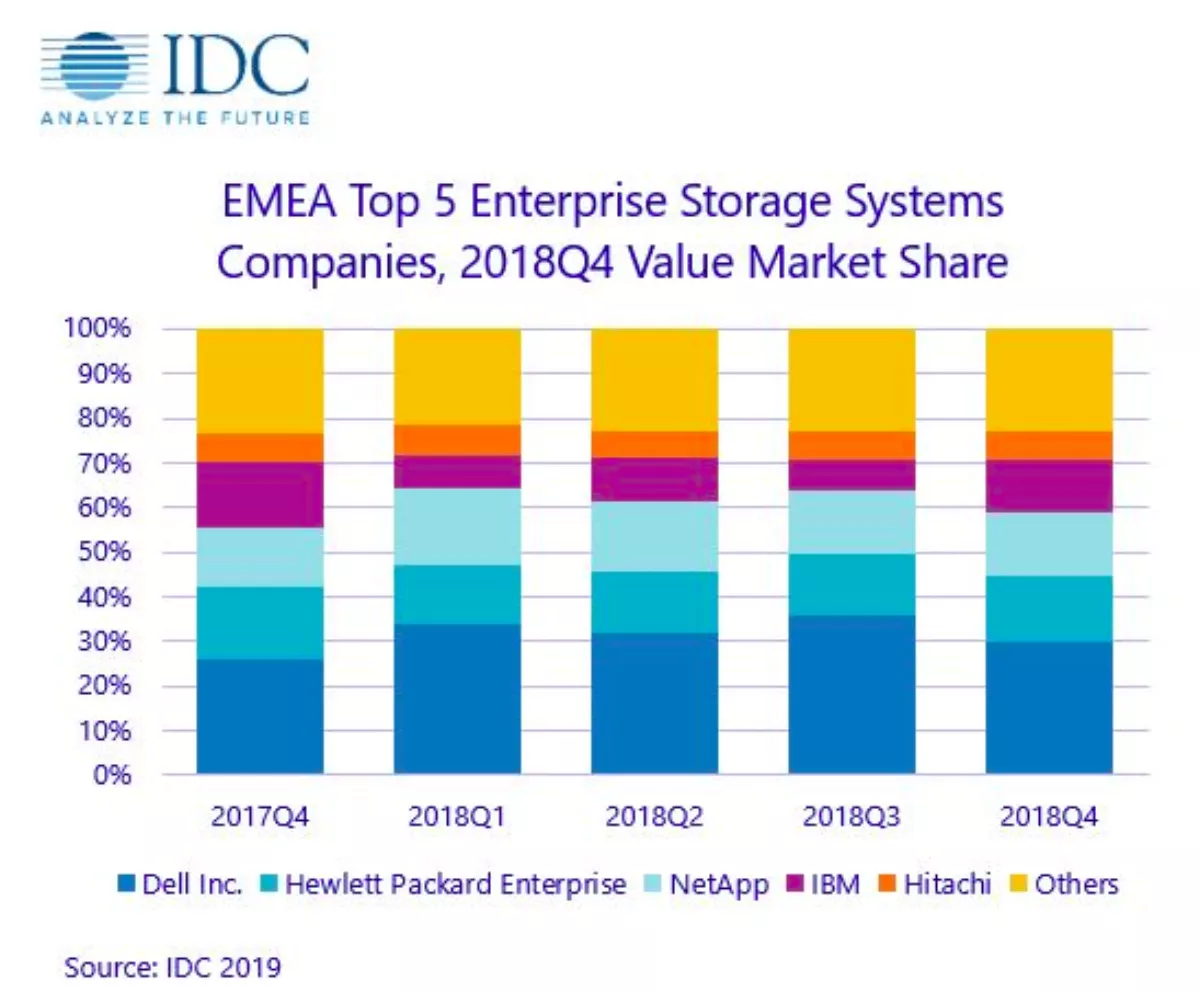

In terms of vendors, Dell EMC extended its lead at the top of the pile after posting substantially higher growth than any of the other top five vendors. HPE came in a somewhat distant second after falling 1.37 percent over the quarter, with NetApp nipping on its heels and followed by IBM and Hitachi.

In terms of regions within EMEA, the Western European market grew 10.1% in dollars and 13.6% in Euros in value terms. All-flash arrays played a big part in this increase, at just shy of 38% of total shipments with a year-on-year increase of nearly 25%.

"Storage spending has so far demonstrated great resiliency in the face of political and economic instability hitting the region, with digital transformation–led investments progressing unscathed," says IDC European Storage and Data Center Research manager Silvia Cosso.

"Companies are updating their data centers for the new wave of IT transformation coming from AI workloads and edge-to-core-to-cloud integration, adopting emerging technologies such as NAFA, or NVME-AFA, arrays to take advantage of the great workload consolidation such arrays enable."

In Central and Eastern Europe, the Middle East, and Africa (CEMA), external storage spending growth trailed Western Europe after recording single digit year-on-year growth of 7.5%.

The regional growth came on the back of flourishing growth in the Central and Eastern European (CEE) storage market (20.5% year-on-year), where almost all individual markets, except Central Europe, recorded growth.

Performance in the Middle East and Africa (MEA) was more varied (-4.2% YoY) as the smaller countries saw a significant increase in storage shipments while the bigger countries, such as Turkey and South Africa, lagged.

"The external storage market in CEMA is strongly supported by refresh cycles in CEE and large-scale digital projects run by governments across MEA," says IDC CEMA Storage Systems research manager Marina Kostova.

"The boost also comes from vendors expanding their presence in the region and by the entrance of hyperscalers that did not have data centers in the region until now.