Channel partners growing in importance for cloud services

There's no surprise that the global cloud infrastructure market had another booming quarter in Q4 2018.

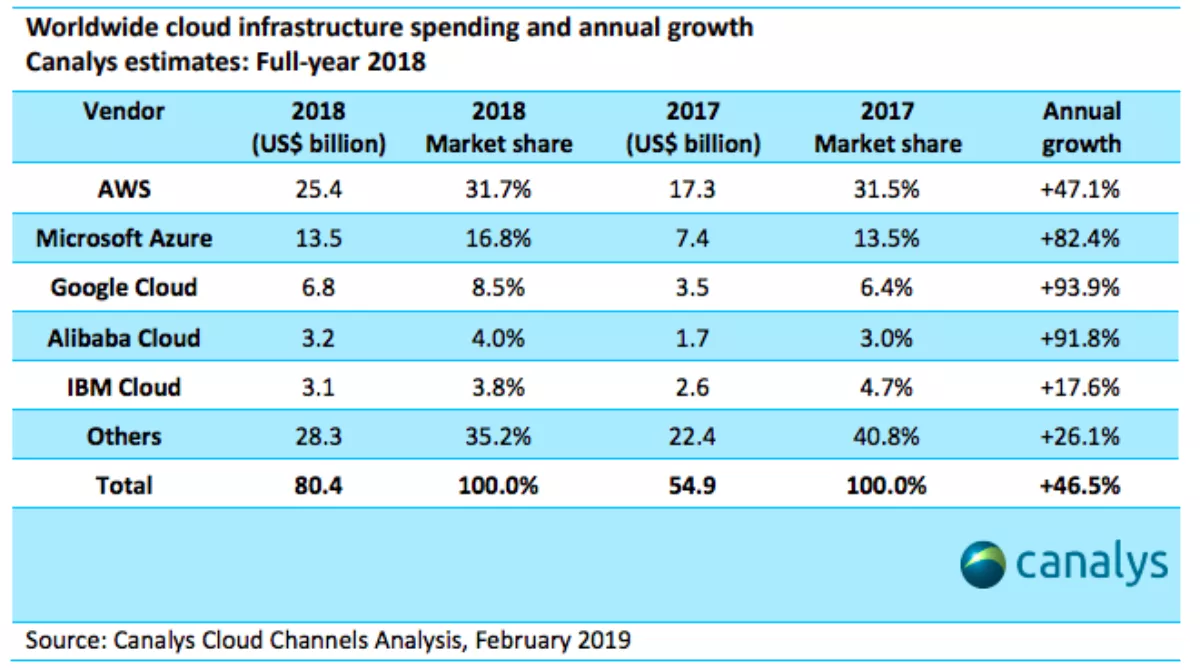

According to new data from Canalys, spending surged 46 percent to reach almost US$23 billion, while total outlay on cloud infrastructure in 2018 surpassed $80 billion - up from $55 billion in 2017.

Canalys principal analyst Matthew Ball says this makes it one of the most important sectors in the IT industry, not just by the rate of growth but also its expanding size.

In terms of the cloud service providers, Amazon Web Services (AWS) maintained its dominance in Q4 2018 with an unchanged 32 percent share of the market. Meanwhile somewhat further back was Microsoft Azure, although the company did manage to grow its share to 16 percent from 14 percent a year earlier.

Google Cloud reached 9 percent market share for the first time, while Alibaba Cloud retained its 4 percent share. The top 10 cloud service providers was rounded out by IBM, Salesforce, Oracle, NTT Communications, Tencent Cloud and OVH.

"Cloud infrastructure services provide the core components needed to support businesses' digital transformation initiatives around building new customer experiences, deploying IoT to transform processes, using big data and analytics for better insights, and embedding machine learning and AI for automation," says Ball.

"Market dynamics have changed over the last 12 months, with more businesses opting for multi-cloud and hybrid-IT environments to use the strengths of different cloud service providers and deployment models dependent on application and data requirements, compliance, cost and performance.

Canalys chief analyst Alastair Edwards says channel partners are benefitting from this huge growth in the market, with roles like understanding customer requirements, recommending services, deployment and integration, as well as simplifying the billing and management of multiple cloud services growing in importance.

"Cloud service providers are placing greater emphasis on building channel programs to support the growing network of partners beyond the largest systems integrators, especially as they extend to mid-market and SMB customers," says Canalys Edwards.

"Canalys expects the share of cloud business handled by or with channel partners to increase in 2019. Cloud service providers must therefore find ways to improve their own differentiation to partners and raise the maturity of their channel models.

Moving forward, Canalys says there will be a greater focus on rewarding partners for developing unique services on top of cloud, driving customer adoption of cloud services, and maintaining specialist expertise around specific cloud deployments like SAP HANA, analytics, or security.

"Cloud service providers need to build trust with channel partners and not implement initiatives or change terms and conditions that drive more direct sales," says Edwards.

"Microsoft is the current dominant force in the channel for cloud services, through the continued expansion of its Cloud Solution Provider (CSP) program. But as it offers more direct purchasing options to Azure customers through its new Microsoft Customer Agreement, its partner strategy faces increased scrutiny. This creates an opportunity for rivals to exploit growing uncertainty among Microsoft's partners.